How to select Weekly Bases!

Disclaimer: Everything shared here is for educational purpose only and nothing discussed here to be taken as a buying or selling call. Please trade at your own risk management. Not SEBI registered.

Topic of the Week: How to select Weekly Bases

There are many ways a trader can choose to trade but no matter what style one goes for, there will be always a problem of too many setup to select from. So, here in this newsletter we will discuss on how to select weekly bases and then how to narrow down the list.

I will be discussing this topic from the perspective of what parameters i use. So, my suggestion will be after going through my method, go and verify on charts and modify it as per your style.

To understand what we mean by weekly bases kindly go through the below newsletter.

Lets first look at some examples to get a visual for better understanding.

It becomes very clear from the examples on what I look for, Prior upthrust and then a 4-6 weeks of consolidation. Looks very simple right because it is simple.

There will be many stocks setting up in 4-6 weeks of consolidation at a time but not every stock will have the same power or we can say not every counter will have leadership characteristics. That’s where you can differentiate yourself as a trader and can outperform by having the best possible counters in your list.

Steps to be followed to create a process for identification of weekly bases:

Step 1: Do a basic volume filter scan on Chart-ink on weekends to get a universe of stocks and then move them to Trading view or any other charting platform you use.

This is the basic chart-ink formulae you can use to filter stocks on basis of revenue it do in a day which ultimately take cares of the volume. Make sure that you are going with approx. 100 times revenue of what your position size to avoid in illiquid stocks and avoiding slippages.

Step 2: Now once you have populated the shortlisted universe in your charting software its time to sit on weekends and scan through them to make short list of potential leading stocks. This is one of the most crucial step of the process as here you need skills to distinguish between laggards and potential leading stocks, even you have to take decisions to remove slow leaders if you are only interested in trading fast movers to increase your potential further.

How to Distinguish between leading stocks and laggards:

I have shared 3 examples from same sector on same date for better comparison on how to distinguish between leaders and laggards even when you see a laggard setting up and looking good to go.

Lets assume we were going through our weekly scanning and we come across these 3 stocks, which ones we can say are leaders of the sector?

The clear answer is Kaynes technology! This counter has moved well compared to its peers where as other especially Amber is just sitting near lows by showing less momentum. Now if we look at these counters on this day we can also say that Amber is offering a base where entry can be done and its from a good sector, that’s where we may get stuck with a laggard and waste our time with a slow mover where we could have been sitting in a potential leader.

So, in weekly scanning we have to pick stocks like Kaynes to put it in our potential leading stocks list. Even Avalon is showing better momentum and moved much better compared to Amber so we can still have this in our winners list but Amber as of now its not a leader.

Note: A counter due to some catalyst can move quickly and turn itself to a leader from a laggard but that’s a rare event and we don’t put our money in rare events.

Lets take few more examples:

Now while going through these 2 counters we can clearly identify the leader, am i right?

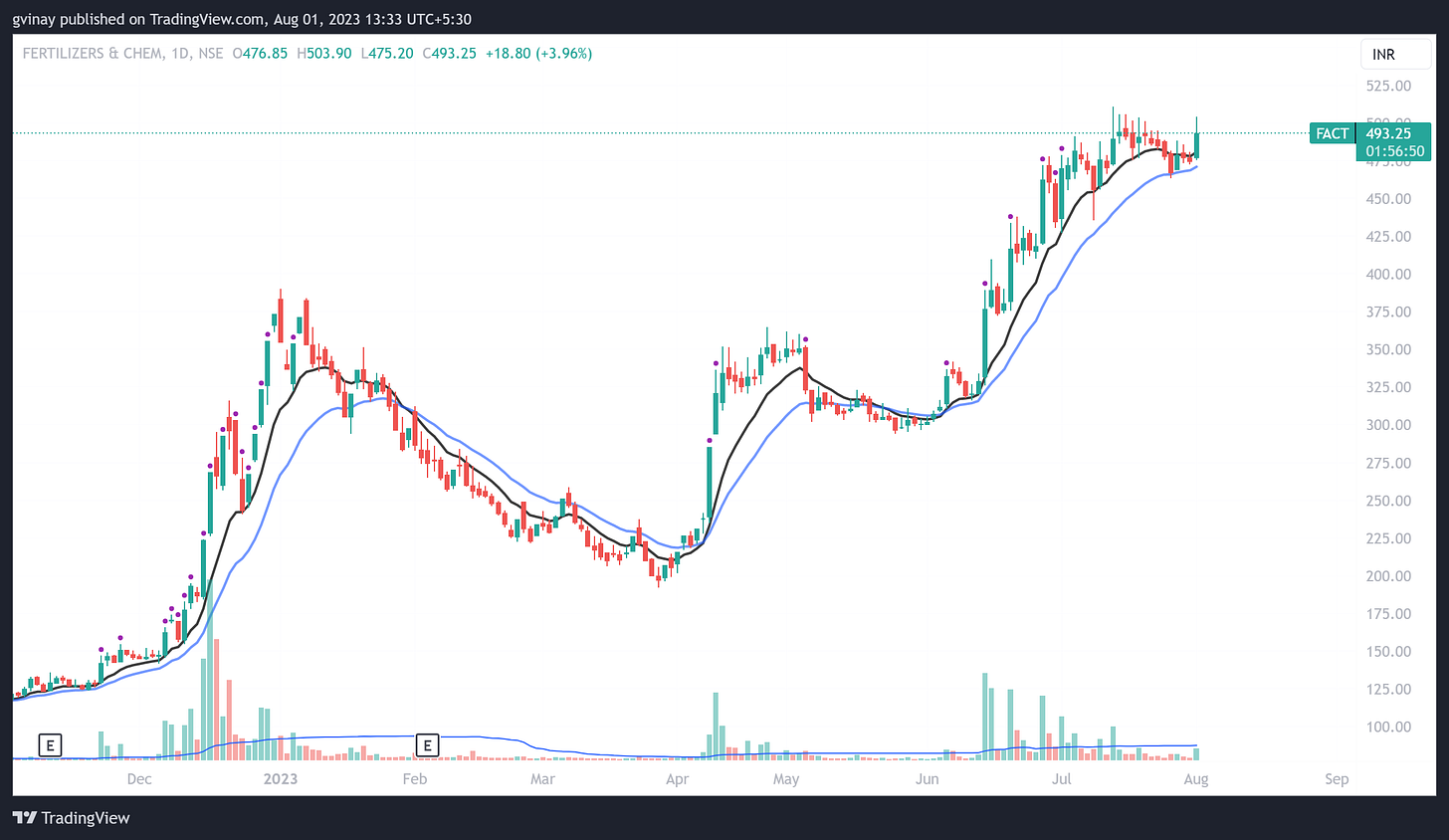

Yes Fact here clearly stands out as leader from this sector and from these counters.

So, in this way we have to create a list of stocks which are clearly standing out as leaders, there is no doubt on whether they are leading or not.

Note: Now as soon as shortlist them, that does not mean that they are ready to put trade, they are just merely potential leaders which can give you the best moves compared to other stocks form same sector. You have to wait for a good entry in them before jumping on them.

Step 3: There are two main ways to trade leaders once you have identified them in your weekly scanning.

One is Short Daily bases and other one is Weekly bases. We already discussed basics of both in our previous Newsletter.

Here we will focus on Weekly bases!

Now we have a list of potential leaders ready with us, from here on we have to go through this list daily to find counters which have the potential to resume the uptrend from the weekly bases and put them on our focus list for tomorrow.

While selecting weekly bases for focus list we need to keep this in mind that these bases will have consolidation periods of approx. 4-6 weeks. As the basic behind them is to trade the stock for a longer period of time after entry probably till next weekly base by going through small pauses and then selling most of it in strength. So, basing of the counter must happen around 20 ema as it provides enough time to throw out many weak hands and sets up for further leg.

Lets understand it with examples

This is how weekly bases will look like. Most of them takes support from 10 and 20 ema while consolidation and also many will do a shakeout below 20 ema. Further, while selecting bases we need to avoid setups where there are many big red bars with high volume as they are bad indication and also the volume shall dry as the counter moves towards the end of consolidation.

At the end of this consolidation Price and volume both will start contracting as we can see in above examples as how tight price has gone in last days before breakout and resumption of next leg.

That is how we create a short crisp focus list with potential leaders in them and ride them for good gains.

How to enter and what shall be the stop loss are topic to be covered in details so lets have them in upcoming newsletters. So, follow & subscribe for regular updates.

Special Topic: Risk Management

How to proceed one’s we have such corrective market events where many of our Stop loss gets hit and we observe increased volatility in the market.

Do & Don’ts in such scenario’s:

Do not keep trading at the same frequency or aggressiveness you were trading earlier.

As you find a setup to trade and want to test the strength go with low size as you get good feedback increase the size to normal gradually.

Save the Mental capital by not becoming the part of volatility, Sit in patience for your set ups to develop.

Save your capital & confidence by keeping drawdowns minimal by reducing your exposure in volatile times.

Performance of Weekly bases:

Thanks for taking the time out to read this newsletter, We will be jumping into more depth in coming weeks in topics like Entry, Stop loss and Exit.

Kindly share which topics you would like to be covered in upcoming newsletters on my Twitter handle.