Weekend Diary 11 May 2024

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as investment advice.

Topic of the Week- Stop Loss, Trail and Exit !

Never a day passed when i haven’t received a question on trailing your positions or booking the profits. So, today we are diving into the field and lets try to understand it with practical examples.

Trailing a position can’t be looked in isolation as we need to co relate it with current location of price in the overall trend.

I have explained the process with practical examples in the below lesson.

Make sure to follow and share to receive such valuable lessons.

Situational awareness

Situational awareness in short is your stance on how are you going to act. It can be Aggressive, staying light or sitting out.

But having the awareness adds big time to your trading edge. It can be inferred through many tools but we will be using Indices and some market breadth tools.

1. Indices

Small Cap Index:

The correction started in Feb 2024 which went a bit deeper undercutting 50 moving average which caused a dent in many stocks. Then in last weeks of march we saw the index pulling back above moving averages with very strong action on 1st April 2024. This kind of hinted that we might done with correction and starting a new leg which was confirmed with many successful Breakouts happening around.

Now after a decent move in April 2024 markets seemed like taking a much needed pause which became a deeper correction then expected one with Indices moving to 50 day average.

Now we are standing at such a crucial point where if the market has to maintain the momentum then it may hold the points and relieve the selling pressure because if it starts to go down further then we have to wait and watch.

Currently my stance is, i am waiting for reversal with my list ready in case it happens to get in with progressive exposure as some confirmation from markets appear. If it goes against the plan, will move to sidelines by putting SL in existing positions, keeping myself safe.

2. Market Breadth

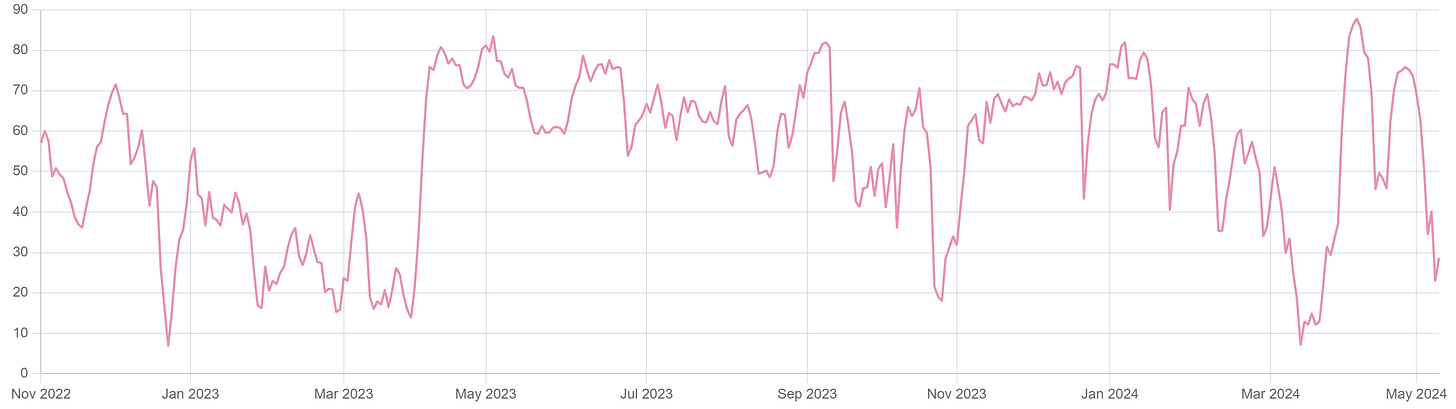

We will monitor market breadth using % of stocks above 20 ema as shown below. It is basically indicating how bullish the market is or how bearish it is at the moment.

Usually when the % comes up 60-65 area this starts to show that the bullish momentum is strong or getting stronger but this cannot be used in isolation definitely.

We can only use this as an supporting tool to our bigger awareness which is coming from Index and broader market research which we will touch as we move along.

So, here it shows that market had a deep correction with the % moving close to 20 which are kind of extreme levels on oversold conditions. So, in such cases this ratio may come handy.

Let me tell you how:

We knew as of now market is in broader uptrend with a correction happening. So, in up trending markets such points become crucial to watch along with where the index stands to an idea that to maintain the bullish uptrend on broader terms market may take a pause here or reverse. So, in such scenarios we can be ready to deal with either of the scenario instead of sitting in shock on what has happened in the markets.

Sector heat Map

Markets is mostly about sector rotation in shorter time frame. It will start with sector A & B and then meanwhile Sector C & D will be setting up to take lead to continue the rally further.

Sectoral Heat Map!

My Trading week experience

In this segment i will be sharing my personal experience in the week as trading is not a straight line business, it comes with lots of emotions.

This week came with lots of mistakes where i took some anticipation entries when the market was in pause and correction in expectation of it reversing soon. But the market starts to get extended on downside and that makes the new positions hit SL leading to more pressure on already existing positions. So, this gave a dent on portfolio definitely but also created problems for the existing positions as psychology gets effected.

In short when markets are in turmoil , anticipation may be avoided and things shall be added a bit later on better confirmation until the reversals are highly likely.

Where to find market breath sheet like your